Make your life easy with an online accounting tool like the one offered by Bonsai. That includes freelancers youre running a business.

Tax Deductible Expenses For Artists Freelance Tax Tax Deductions Deduction Writing Jobs

Itll turn out to be Schedule C profit 09235 0153.

. This calculates your Social Security tax and Medicare tax on your profit. While many of your clients may come from word-of-mouth marketing tools are an often overlooked deductible expense. Here are a few ways you can access makeup artist tax deductions.

Yes the IRS likes consistency so it is always a good thing to report business income and expenses the same way year after year on your tax returns. Hire an accountant to do the work for you although youll still have to keep record. The administrative and reporting requirements can be daunting for a Tattoo Shop Owner.

First theres a special deduction for expenses paid in 2018 to earn employment income from an artistic activity. An artist may also deduct the cost of museum and gallery memberships traveling to tattoo shows whether you work there or not and even trade magazine subscriptions as business-related expenses. My husband is a tattoo artist and makes 60 off each tattoo and the shop takes 40 of that can we deduct the 40.

If you do report sales income use a 1040 Schedule C to report all sales revenues and expenses that pertain to your art making practice. All of money you spent to make that work goes on line 4 this is where your receipts come in handy. Tattoo artists usually learn their craft via an apprenticeship under a.

Youll need to pay your state income taxes FICAMedicare 153 and whatever you Federal marginal rate is. Enter the amount from the Total expenses line 9368 on line 22900 of your return. Artists benefit from two interesting exceptions to this rule.

Im a tattoo artist working for a shop. Whether youre looking for photography tax deductions help with. An artist may also deduct the cost of museum and gallery memberships traveling to tattoo shows whether you work there or not and even trade magazine subscriptions as business-related expenses.

10 11 References Form 941 Employers QUARTERLY Federal Tax Return Form 940 Employers Annual Federal Unemployment FUTA Tax Return Form 1040-ES Estimated Tax for Individuals Publication 15 Circular E Employers Tax Guide Publication 505 Tax Withholding and Estimated Tax Publication 531 Reporting Tip Income Publication 583 Starting a Business and. Artists who make more than 400 in a calendar year are subject to self-employment tax. The self-employment tax rate is 124 percent for Social Security and 29 percent for Medicare tax relief legislation for that year notwithstanding.

Premier investment. Sounds like your accountant wanted you to do an S-corp which is good. Generally Tattoo Shop Owners as a business must withhold income taxes withhold and pay Social Security and Medicare taxes and pay unemployment tax on wages paid to an employee.

You can also include museum trips and research expenses if they relate directly to the work you. A tattoo artist also tattooer or tattooist is an individual who applies permanent decorative tattoos often in an established business called a tattoo shop tattoo studio or tattoo parlour. As a tax preparer and financial consultant who has prepared taxes for freelancers and artists in New York City for over 20 years I am presenting this website to give you basic information to help you deal with your freelance taxes and freelance finances.

Expenses can include obvious things like art supplies and studio rent but they can also be costs relating to a studio space in your home and portions of your phone and internet bills. You may have to be lisenced as a professional to claim deductions as a professional tattoo artist. In different parts of the country and in different states tattoo shops are run in different ways.

However by hiring Tattoo Artists as independent contractors a Tattoo Shop. Use this list to help organize your art tax preparation. Use Schedule C if your expenses are greater than 5000.

All of the money you earned from selling your art goes on line 1. Any of the following must apply to you. Doug just like any other profession it is important that you file taxes keep reciepts of your supplies and equipment for deductions.

The tax applies to 9235 percent of net income which is defined as total income minus necessary business. Keeping track of your expenses is to your benefit as an artist. Deluxe to maximize tax deductions.

I havent talked to all of them so I cant be sure. But they are required to pay taxes just like every other business. Youre able to claim this deduction if youre in a recognized artistic field as defined in the Income Tax Act.

You pay this with your income taxes but you also get a deduction of half this amount before you calculate the income tax. Do I give the shop a 1099 or do they give me one. Enter the amount you can deduct on the Artists employment expenses line 9973 of Form T777 Statement of Employment Expenses.

Apr 06 2015 If youre making and selling art as a hobby related expenses can be deducted only if you itemize and only to the extent they plus any other miscellaneous itemized deductions you have exceed two percent of your adjusted gross income. As a self-employed person getting a 1099 you are responsible for paying your own taxes. You may have others.

Set up your own system to track deductions and file a tax return. Answer 1 of 2. This is a basic list of typical expenses incurred by artists.

My name is Susan Lee. I pay the shop 50 of what I make. Art supplies Books magazines reference material Business gifts Business insurance Business meals Cabs subways buses Copying printing Cultural events museum entrance fees Entry fees Equipment and software Film.

Art Gallery and Tattoo Studio Offering Custom Tattoos Paintings Clothing Accessories More.

3 Types Of Tax Deductions And How To Track Them

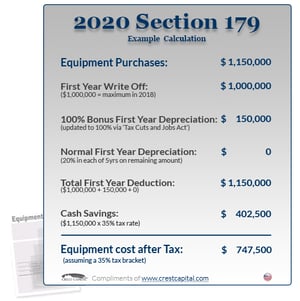

Deduct Your Tattoo Removal Laser All About Section 179

3 Types Of Tax Deductions And How To Track Them

Writing Off Business Expenses With Schedule C Ride Free Fearless Money

Spsinspections Homeinspection Homebuyers Homesellers Homeowners Realestate Realestateagent Househunting Local Canadian Tattoo Recycling Kelowna Tattoo

New Baby Tax Deductions Credits Exemptions Tax Info For Parents Heart Art Heart Tattoo Anatomy Art

How To File Taxes As A Tattoo Artist How To Discuss

Keeper Monitors Your Purchases For Tax Deductible Expenses When We Find One We Text You That S It Subscribe For Year R Online Taxes Tax Prep Tax Deductions

0 comments

Post a Comment